Financial Statements

It is a collection of financial data related to an entity, presented in the form of written reports. These reports often include information about income, including revenues and expenses, information about the financial position including assets and liabilities, and information about the results of the entity's operations, whether profits or losses. These financial reports and the information they contain help clarify the financial status of the entity at a given time or over a specified period. In other words, financial statements are the means by which entities communicate financial information to the users of these statements.

The financial statements aim to

to provide financial information about the prepared entity that is useful to investors, lenders, and other creditors, both current and potential, in making decisions regarding providing resources to the entity. These decisions involve purchasing, selling, or retaining equity and debt instruments, as well as providing or settling loans and other forms of credit. Financial statements are prepared using a common language among the preparers of such statements known as (accounting standards).

Types of financial statements

• Statement of financial position.

• Statement of profit or loss, and other comprehensive income.

• Statement of cash flows.

• List of changes in shareholders' equity.

In addition to the above four financial statements, the financial statements include notes to the financial statements (the "Notes"), which are an integral part of the financial statements. These notes include a more narrative and detailed detail of the four financial statements. The financial statements are divided according to periods into two parts: interim financial statements and annual financial statements. Where the interim financial statements cover a period of time less than a year, often on a quarterly basis (quarterly) or semi-annually (every six months), while the annual financial statements concern a full year (twelve months) and with regard to the interim financial statements may include a full set of financial statements or a brief set

First: Statement of Financial Position

The statement of financial position represents a depiction of the rights and obligations of the entity at a specific date. It includes the assets of the entity (its resources), its liabilities (its obligations), and the equity of its shareholders. The three elements that comprise the statement of financial position can be summarized as follows:

- The assets of the establishment (its assets).

- Liabilities of the entity.

- Shareholders' Rights.

Assets = Liabilities + Shareholders' Equity

Assets:

They are economic benefits or resources controlled by the entity that contribute to providing future economic benefits such as the production of goods, generating returns, or contributing to achieving returns for the entity. An entity can own assets, just as an individual owns assets. Examples of assets (resources) at an entity include:

- Cash.

- Inventory.

- Estates.

- Intangible assets such as trademarks.

- Investments in other facilities.

Liabilities (Obligations):

They are financial obligations arising on the enterprise, where the obligation is a duty to pay to other parties. Most establishments, even profitable ones, have obligations, and examples of liabilities (obligations) on the enterprise include:

- Payable expenses.

- Loans from the bank.

Assets = Liabilities + Shareholders' Equity

Shareholders' Rights:

It is the remaining share in the assets of the entity after subtracting all its liabilities

Shareholders' Equity = Assets – Liabilities

It can be said that shareholders' equity is the money invested by the owners of a company's shares in addition to the profits or losses accumulated by the company since its inception. Sometimes companies distribute those profits instead of holding them. This process is called (dividends).

Second: Statement of profit or loss and other comprehensive income

This list is divided into two parts:

First: Statement of profits or losses This statement displays the recognized revenues and expenses for the financial period to reach net income or net loss. Also known as the income statement. Second: The statement of other comprehensive income, which begins with net income or loss from the income statement and continues with the elements of other comprehensive income to reach the total comprehensive income, and unusual and non-recurring items are shown within the income statement such as: currency translation differences, surplus revaluation of unrealized profits from financial assets and changes in fair value. In general, the statement of income and other comprehensive income is the most analyzed part of the financial statements. This is due to the fact that it provides a breakdown of the entity's sources of profitability based on its performance from selling its products, providing its services or returning on its investments.

Reading the income statement and other comprehensive income is not limited to deducting total expenses from revenues, as the entity generally has more than one source of revenue and many different types of expenses. In the statement of income and other comprehensive income, the entity details the different sources of its revenues and expenses that reflect a clear picture of the entity's performance. Here are some of the most important points included in the income statement:

- Revenue or sales.

- Cost of revenue.

- Total profits.

- Expenses.

- Net profit or loss.

- Operating profit « income from the operations of the main enterprise ».

- Non-major gains and losses.

- Profit or loss of the stock.

When the investor understands what is meant by these figures and what their relationship to each other is, he can identify and measure the performance of the enterprise. For example, a troubled entity—which may not represent a good investment—may be suffering from continuous increasing expenses and decreasing revenues that reduce its total profit and net income.

Net Income:

Net income is one of the most important items in the profit or loss statement, as it reflects the results of the entity's operations during a certain period of time. Net income can be seen as the results of our investments in that entity by knowing the return on share. It is important for the reader of the financial statements, especially the results of the entity's business, represented in net income, to see the sources of those profits. Was it from the work of the operating entity, or from accidental acts or circumstances such as making a profit from the sale of an asset of the entity that is used in the operational business, in order to be able to evaluate the performance of the enterprise correctly.

Third: Cash Flow Statement:

The cash flow statement is of high value to any entity as it shows the volume of cash inflows to and out of the entity, and shows the sources of cash and similar funds and ways to spend them on operation, investment and financing.

What makes cash flow so important?

The answer is that an entity cannot succeed without cash or similar assets to pay its operating expenses, debt receivables and so on. Without the availability of cash, the enterprise cannot finance its investments to develop its activity.

Contents of the Financial Flow Statement

- Net cash from operating activities: Shows the volume of cash flows from or used in the entity's operating activities such as cash flows from income.

- Net cash from investment activities: Shows the size of the entity's cash flows from or used in its investments, such as cash flows from receiving dividends from associate enterprises.

- Net cash from financing activities: It shows the size of the entity's cash flows from the sale of its shares, issuance of debt instruments, or repayment of loans or financing obligations. Such as cash flows generated by loans.

What are the most important items to consider in the cash flow statement?

One of the most important items that must be considered within the cash flow statement and given great importance is the cash flows from the operating activities of the entity, and that these cash flows take a positive character (inflows into the entity), are relatively large, and take an increasing upward curve over time. Regardless of the level of cash flow achieved for the entity, it is assumed that the three categories included in the cash flow statement (operational, investment and financing) are checked, and that the investor tries to know which activities generate the largest amount of cash flows for the entity, and how these flows are employed. In this way, this can help the investor predict the future performance of the enterprise.

It is worth noting that having high profits in the entity does not necessarily mean a positive cash flow, as it is possible that there are items in the profit and loss statement that raise profits and are not cash. Other times, there can also be negative cash flows that do not give a bad impression of the performance of the entity if the entity uses its amounts to purchase investment assets that support the expansion of its activity to achieve good future performance.

Fourth: List of changes in shareholders' equity:

- Money capital

- Reserves: These are amounts withheld from the profits of the enterprise to achieve certain objectives such as strengthening the financial position of the enterprise or expanding investment.

- Retained earnings: These are the profits that the entity reinvests instead of distributing them as dividends to shareholders.

Shareholders' equity is defined as the obligations owed by the entity towards the owner of the establishment (owners), and this list is prepared to know the changes that have occurred in the rights of the owners of the establishment during the financial period or year, where the shareholders' rights increase with the increase in capital and retained profits, and shareholders' equity decreases with capital reductions, losses and dividends.

Fifth: Clarifications:

- Notes are an integral part of the financial statements and are detailed information attached to the financial statements in order to give a better understanding of the items contained in the financial statements and the accounting policies followed in the preparation of the financial statements. Shareholders need a lot of detailed information that does not appear directly in the body of the financial statements, so it is important for the investor to read these explanations and understand them well because they are considered a detail of the financial position of the entity. Also, the notes may provide information that is not found in the body of the financial statements, such as subsequent events that relate to events after the financial statement period but before the issuance of those statements, such as the existence of a material event (combustion of the entity's inventory) on the entity after the end of the financial year and before the issuance of the financial statements, so the impact of this event will appear in the attached notes without affecting the results and work of the entity in the financial statements.

Correlation of financial statements with each other

Although a simplified explanation of each statement of financial statements is presented, it should be noted that the four financial statements (statement of financial position, statement of profit or loss and other comprehensive income, statement of cash flows, statement of changes in shareholders' equity) are interrelated. Each list has a different view, and provides certain information, but all these lists are interrelated and complementary to each other, as the changes in assets and liabilities that appear in the statement of financial position are reflected on revenues and expenses in the statement of profits or losses, which results in the existence of profits or losses on the entity. The statement of cash flows provides additional information on cash assets included in the statement of financial position. Finally, it can be said that you must view and read the financial statements together and not be satisfied or rely on a specific financial statement without considering the other financial statements

Report of the External Auditor on the Financial Statements:

The auditor's report shall be in the form of a written report, and the auditor's report shall have a title that clearly indicates that it is an independent auditor's report, and the report shall include the auditor's opinion, and whether the financial statements prepared by the entity have been prepared in all material respects in accordance with the approved financial reporting framework.

Types of opinions of external auditors:

Unmodified opinion:

The External Auditor shall express an unmodified opinion when he concludes that the financial statements have been prepared in all material respects in accordance with the applicable financial reporting framework, and the unmodified opinion may include a drawing attention paragraph or another matter paragraph. Where the external auditor may deem it necessary to draw the attention of users to something that has been presented or disclosed in the financial statements, which forms the basis for users' understanding of the financial statements, he must include in his report a drawing attention paragraph. If the External Auditor deems it necessary to report something other than those presented or disclosed in the financial statements that is relevant to users' understanding of the audit, he or she shall include a paragraph of another matter.

modified opinion:

The External Auditor shall give a modified opinion if the financial statements or an item in the statement is materially misrepresented or if he or she is unable to obtain sufficient evidence for audit. The revised opinions are: a conservative opinion, an opposing opinion or a refusal to express an opinion. The external auditor's report is one of the important things that the investor must read and understand the paragraphs contained in it in order to be able to make the appropriate investment decision for him.

Types of opinions of external auditors:

Ratios are used to measure the relative size of any two numbers. Although some shareholders believe that complex financial ratios are only useful to financial analysts and experienced shareholders, this is not true, especially if you take into account the amount of financial information of enterprises currently available on the Internet and Tadawul. Financial ratios provide the investor with a simple and fast way to judge the financial performance of the entity over a certain period of time. These ratios can also be used to compare the performance of enterprises in the same sector or compare them with the average performance of enterprises in the market. While analysts have many of these ratios or indicators, most of them are expressed in either percentages (%) or a numerical multiplier.

Since enterprises vary in terms of their business and services according to their different sectors, some financial ratios become more credible in describing the performance of one sector than other sectors. For example, a financial ratio may explain in detail the performance of banking enterprises, while its use does not give the same clarity with regard to agricultural enterprises. Here are some of the most important ratios used by analysts and investors:

Financial ratios:

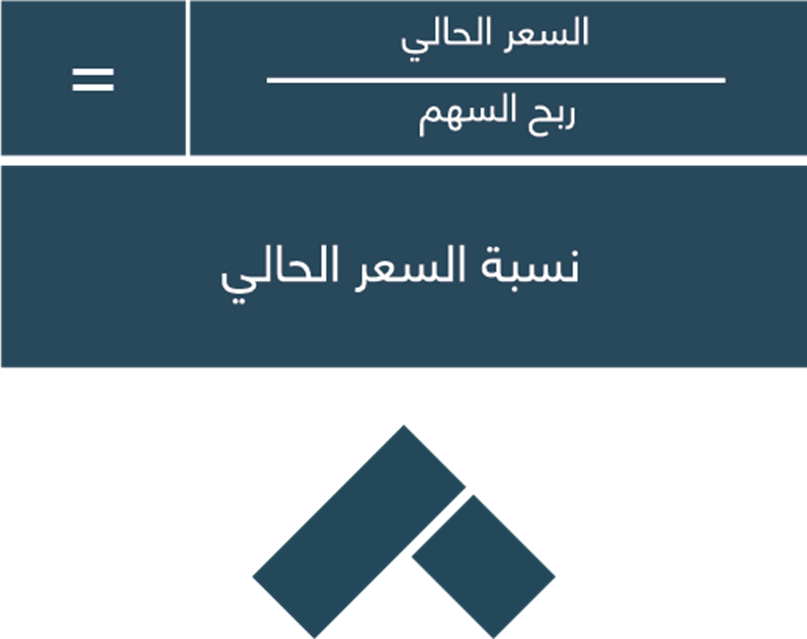

1. Price-to-Earnings (P/E) ratio

Price-to-Profit ratio To examine an entity's profit relative to its share price, investors look at the so-called ratio and the ratio is indicated. P/E Price-to-Profit Price-to-Profit in the facility is sometimes multiplied. To calculate the multiplier, the market share price is divided by the earnings per share on the income statement.

The P/E ratio refers to the price level that investors are willing to pay for each riyal of the current profits of the entity, and also refers to the period of time required to cover the amount paid by the investor to buy the stock assuming the entity achieves the same return in the coming years. The higher the price-to-profit ratio of an entity, the greater the indication of the inflated market value of the share. However, if an entity has a high value for a P/E ratio and at the same time has significant opportunities for increased profits or high growth in the future, its stock will still be attractive to investors despite its high price or P/E ratio.

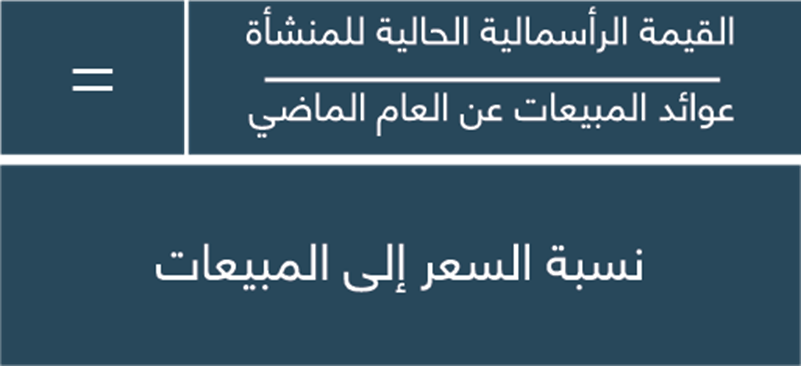

2. Price-to-Sales (PSR) ratio

Even if an enterprise does not make a profit by managing its business, it makes a return every time it sells a good or service. PSR method is the price-to-sales ratio for valuing an entity's value based on its level of returns, and this ratio is presented in multiplier, and is calculated by dividing the capital value of the entity valued at the current market price of the share by its returns achieved in the past year. For example, if the capital value of an enterprise at the current market price is 100 million (20 million shares x 5 riyals per share) and its sales for the last twelve months are 300 million riyals, the price-to-sales ratio. Equivalent to 100 million 300 million = 0.33 PSR

The lower the price-sales ratio, the better the investment value in the PSR. Most analysts believe that the investor should look for a price-to-sales ratio below 0.1 when choosing between a group of establishments for the purpose of investing in one of them.

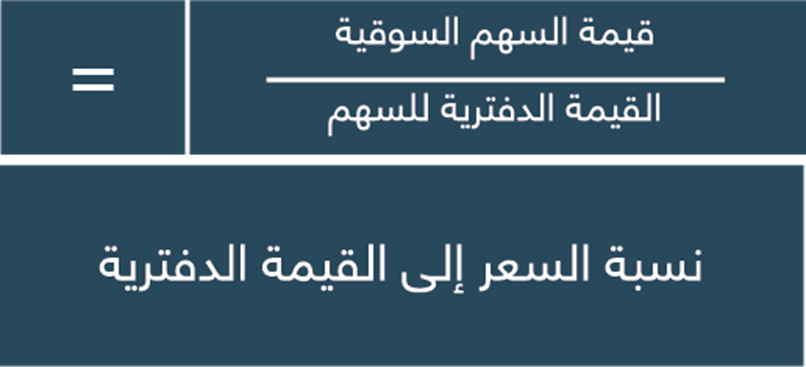

3. Price-to-book value ratio (P/B)

This ratio compares the share price of the joint stock enterprise with the book value of its share and the investor can calculate the book value. P/B per share by dividing the shareholders' equity (assets - liabilities) by the number of shares of the entity issued. For example, if we assume that the entity shows in its statement of financial position that it has assets of 200 million riyals and liabilities of 125 million riyals, the book value of the entity would be 75 million riyals. If there are 25 million issued shares, the book value of each share will be 3 riyals.

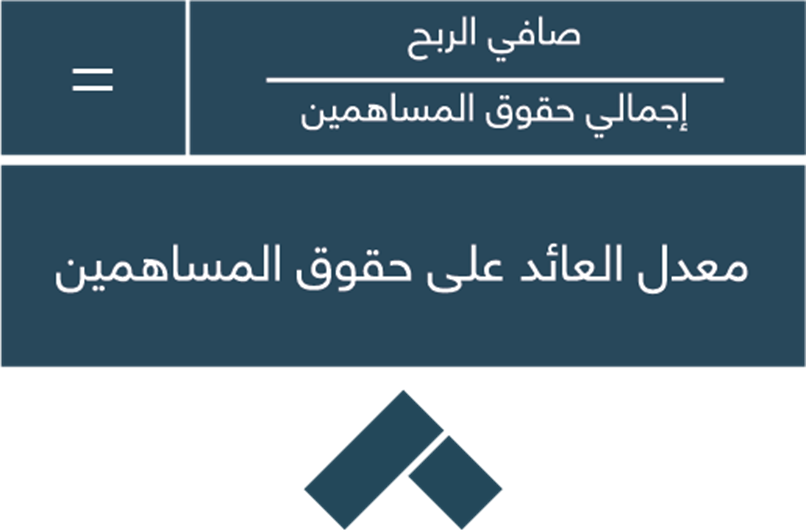

4. Rate of Return on Equity (ROE)

The rate of return on equity measures the ratio of an entity's profit to the size of its shareholders' ROE and is calculated by dividing the entity's net income by the total shareholders' equity. For example, if the entity's net income is SAR 400 million, and its total shareholders' equity is SAR 800 million, the rate of return on equity is 0.5 or (400/800 = 0.5).

In general, the higher the rate of return on equity of shareholders, the stronger the performance of the enterprise. It is a clear indication of good management that the rate of return on equity of the entity over time exceeds the average rate of return on equity for enterprises in the same sector. Sometimes a high rate reflects the tendency of the entity to finance its activities with debt even with a weak return on assets, and therefore it is appropriate to consider this indicator among other indicators without isolation from them.

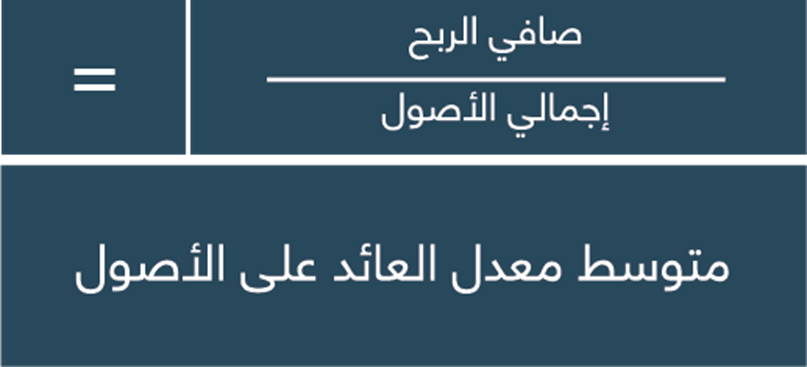

5. Return on assets

The rate of return on assets can provide the investor with an idea of how an entity manages and invests its assets or assets. The rate of return on assets can be calculated as in the following equation:

In general, the higher the rate of return on assets, the more efficient the management and investment of its assets by the enterprise.

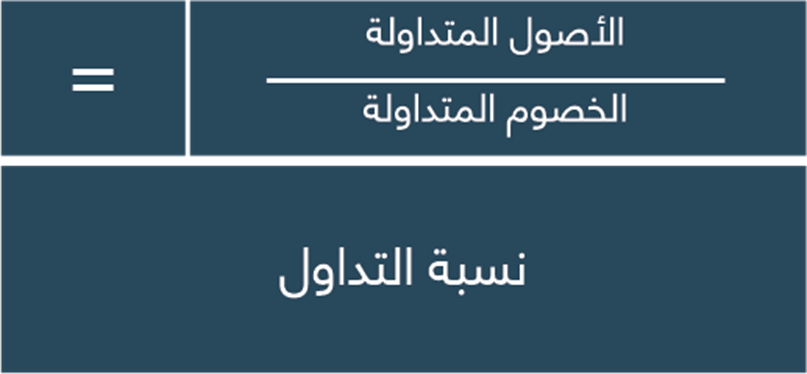

6. Current Ratio

The trading ratio measures the amount of cash available at the entity in the current period. The turnover can be calculated by dividing the current assets of the entity by current liabilities. For example, if the entity has current assets of SAR 50 million and current liabilities of SAR 33 million. SR, the turnover ratio is

In general, if an entity's turnover is greater than 1 and less than 2, it means that the entity is prepared to cover its short-term obligations and operating expenses. If the turnover ratio is much higher, this may indicate the inability of the management of the enterprise to reinvest assets for the purpose of developing its activity, which may reflect negatively on the long-term returns of the enterprise. As mentioned earlier in the discussion of financial ratios, it is important to compare the turnover ratio of the entity in question with the trading ratios of other competing enterprises operating in the same sector, as well as with the average trading ratios of enterprises operating in the entire sector.

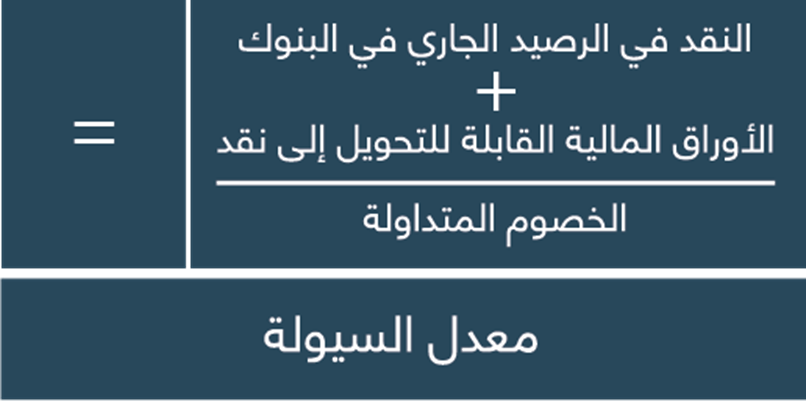

7. Liquidity Ratio

The liquidity ratio is useful when an investor wants to know the liquidity level of an entity compared to any of its competitors. The liquidity ratio can be calculated by dividing the amount of cash available to the entity in its current bank account, plus marketable securities, by the entity's current liabilities. The liquidity ratio can be beneficial when comparing two small, emerging entities with high growth opportunities that are engaged in intense competitive behavior. If the two entities are equal in all aspects, the entity with the higher liquidity ratio is better positioned to outperform its competitor.

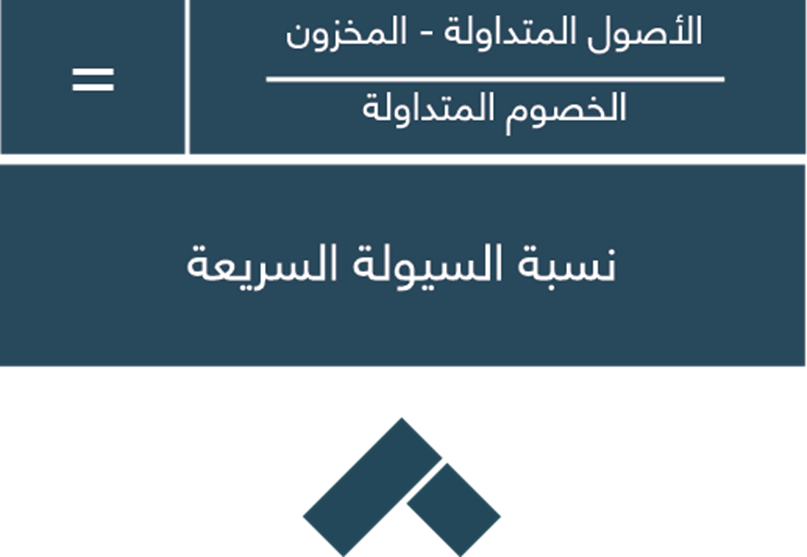

8. Quick liquidity ratio

The quick liquidity ratio is calculated by dividing current assets minus inventory by current liabilities. By subtracting inventory figures from current assets, the investor can know the company's ability to cover its current obligations without resorting to liquidating inventory, which liquidation is a significant loss for the company as it is the least current asset convertible into quick liquidity.